Valuation of Mineral Exploration Properties

Sensible valuation of mineral properties has become more critical through the current market cycle. Valuation of mineral properties at the exploration stage is an area where both valuators and users of valuations need to understand the challenges and uncertainties involved. Sorting the wheat from the chaff can be challenging for non-technical readers of such valuation reports. However, there are a number of aspects that readers should look for to satisfy themselves as to the quality of the work and the confidence they can have in the assigned values.

The Valuator, as defined in the CIMVal Standards and Guidelines for Valuation of Mineral Properties [1] (www.cim.org) must have the appropriate qualifications, and exploration experience relevant to the property being valued, so that the requirements of the relevant national reporting standard (CIMVal Standards and Guidelines in Canada, VALMIN Code in Australia, SAMVAL Code in South Africa) can be satisfied. His or her certificate, attesting to which must be explained, the Valuator should be independent and should undertake a site visit to the property.

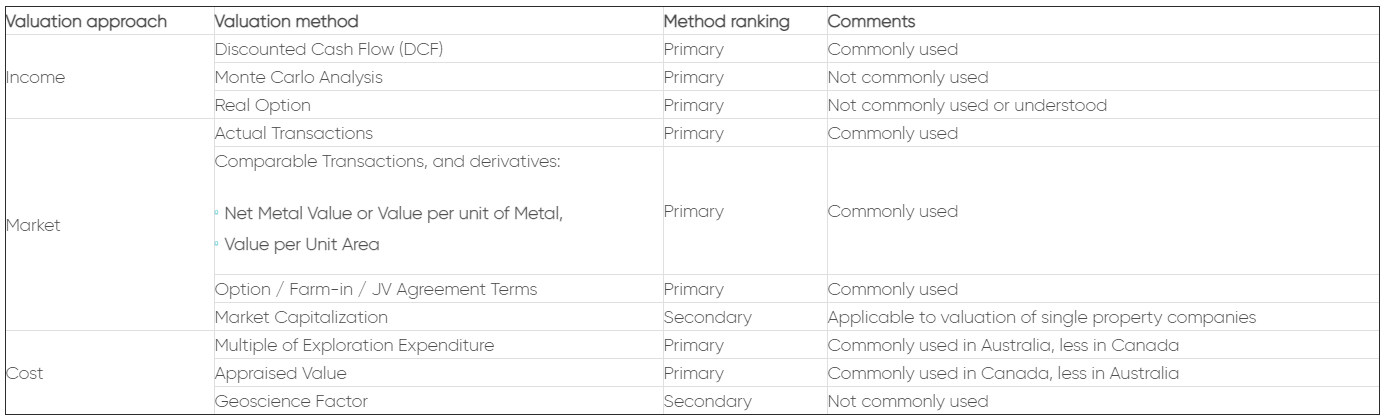

Values should be derived using more than one valuation method whenever possible. The method applied depends on the nature of the valuation, the development status of the mineral property and the extent and reliability of available information. There are three generally accepted valuation approaches in the mining industry:

Income Approach. Based on expected benefits, usually in the form of discounted cash flow.

Market Approach. Based on actual or comparable transactions.

Cost Approach. Based on principle of contribution to value through past exploration expenditures.

Income approaches are applied to later-stage Mineral Resource/Reserve and development properties (and are therefore not discussed further in this article), with Cost or Market approaches being used for exploration and early-stage Mineral Resource properties. Any Mineral Resources or Mineral Reserve relied upon should comply with, or be reconciled with, the relevant national reporting standard, in Canada’s case, with the CIM Definition Standards on Mineral Resources and Reserves, which are referenced by National Instrument 43-101.

Table 1, adapted from the CIMVal Standards and Guidelines, lists a number of valuation methods for mineral properties, classifies them as to approach and specifies whether they are ranked as primary or secondary methods.

Table 1 Valuation methods for mineral properties

With respect to the Cost approach, there are different philosophies on the use of expenditure that is planned or committed but not spent at the time of the valuation. One view (to which the author subscribes) is such planned expenditures should not be included, while another view is that it is reasonable to include warranted future costs. It is noted that Appendix 3G, Valuation Standards and Guidelines for Mineral Properties, of the TSX Venture Exchange Disclosure Obligations for Mining Companies, states ” The Exchange does not generally accept the inclusion of warranted future expenditures for the purposes of the appraised value method“. Whichever approach is adopted, the report must make it clear whether, and to what extent, future costs have contributed to the valuation.

One of the main primary Market approaches is Comparable Transactions (sometimes known as the Real Estate method). This method can provide very useful data on which to base a valuation if a reasonable number of truly comparable transactions can be found. Unfortunately, this is often not the case, and professional judgements have to be made on the basis of a few (if any) truly comparable transactions and a larger number of only partly comparable transactions. If a reasonable database of values can be compiled, derivative methods such as value per unit area of the property or value per unit of contained metal in Mineral Resources or Mineral Reserves can be applied.

Market valuation approaches may involve analyzing the terms of an exploration option or joint venture agreement in order to convert them into the equivalent of a cash transaction at the time of the deal. This is based on the rationale that, in being prepared to incur expenditure to earn an interest in (or “farm-in to”) an exploration property, the purchaser is placing a monetary value on the vendor’s (or owner’s) interest at the time that the deal is made. That value is referred to as the “deemed expenditure”, and it usually represents the full value of the property at the time of the deal. There are generally four components to a joint venture or farm-in agreement:

Cash: This is usually relatively easy to convert to present value. However, if the transaction involves time payment deals or payments dependent on future events, such as a decision to mine, the relevant cash amounts need to be discounted for time and probability of the future event occurring.

Shares: These should be converted to cash using the share price at the time of the deal and treated like cash payments for future amounts. Conversion can be more complex if the shares are in an unlisted company.

Exploration expenditures: Annual exploration commitments are usually part of option/farm-in/JV agreements, with those after the first year optional along with the cash and share commitments. These also need to be discounted for time and for the probability that they will be incurred.

Conditional payments: For example, royalties, feasibility study, sole funding etc. These require adjustment for time, the probability of the project going ahead and, in the case of royalties, the likely parameters on which the royalty could be based. The author’s experience is that the influence of conditional payments on value is usually small because of time / probability discounts and because such payments are generally only a small part of the deal.

Given the subjectivity of the valuation methods used for exploration properties, it is not usually sensible to produce values more detailed than the nearest $0.1 million for significant projects or than the nearest $10,000 for lesser projects. The final valuation is an experience-based judgement based on weighting of the individual values. It should always be expressed as a range in order to reflect the uncertainty and subjectivity of the exercise.

Valuators must ensure that they exercise their independence and do not succumb to client pressure to produce a desired result. The client often has a vested interest in whether a valuation is on the high side, as, for example in a take-over defence, or the low side, as, for example in an assessment of tax liability. Valuators must remain true to their professional obligations and ethics, and resist any such pressure.

The valuation report should be clear, transparent and logically presented, and explain why and by whom the valuation was requested. It should explain why certain methods were used and others were not, and any limitations on their applicability. It must contain all the material information necessary to allow both experts and non-experts to understand how the valuation was derived, including a description of the key risks, assumptions, limitations, and uncertainties. It should compare the result with previous valuations of the property.

Finally and most importantly, the valuation must be consistent with values likely to be assigned in real life.

A key test is: Would you pay $X for the property if it was your money?

For more information of to discuss this article further, please contact your closest AMC office.

Text by Pat Stephenson.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights