Five basic questions on permits, environmental and social aspects of projects and operations

What does an investor need to know about permits, environmental, and social aspects of a project or operation, before making an investment decision?

Ernst and Young’s 2015 report entitled “Tomorrow’s Investment Rules 2.0”[1], involving a survey of more than 200 institutional investors from around the world, examined the investor’s changing attitudes to stranded assets. Stranded assets were defined in the report as those that lose their value prematurely due to environmental, social or other external factors. The survey identified that:

- A notable 62.4% of investors are concerned about the risk of stranded assets. More than one-third of respondents report cutting their holdings of a company in the last year due to this risk, while an additional quarter of respondents plans to monitor this risk closely in the future.

- With the impact of environmental and social changes on commercial enterprises accelerating — generally and in terms of stranded assets — 37.0% of investors today use a structured, methodical approach to analyzing non-financial information related to these risks as part of their investment decisions.

How then, should an investor assess these risks, in a timely and cost effective manner? Often, the best place to start is with the basics. Based on the author’s experience, there are typically five basic questions that are fundamental to gauging permitting, environmental, and social performance risks:

The ‘Basic Five’:

- Are there any existing environmental, social and permitting liabilities?

- Are all permits and approvals in place?

- Is the operation in compliance with the law and other relevant standards?

- Is the project or operation resulting in, or likely to result in, material environmental or social harm?

- Are progressive rehabilitation, closure plans, closure provisions, and security bonds all in place?

Acid and metalliferrous drainage is often a key issue

While these questions may appear simple and obvious, the answers are often complex and require consideration in the specific context of the project; and often, the devil is in the detail.

There is also a seemingly endless range of more subtle subtopics or additional issues that can be equally relevant for certain projects, such as tenement standing, country risk, security, corruption, stakeholders, ethnic and religious considerations, social structure, indigenous communities, vulnerable groups, consultation and community engagement requirements, the activity of non-government organisations, and so on. In fact, the International Finance Corporation’s environmental and social performance standards can be dissected into a long list of issues that may need to be assessed. A detailed review against these requirements might follow on from a review of the ‘basic five’.

Some tips and tricks in getting answers to the basic five questions, and making sense of the answers, are set out below.

Question 1: Are there any existing environmental, social and permitting liabilities?

The answers to this question can be extremely varied, and range from no immediately obvious liabilities, such as at a green field development site, through to massive environmental, social, and permitting liabilities at a brownfields site—such as an acidic pit lake, metaliferrous drainage in a sensitive receiving environment, and a regulator under pressure from anti-mining political and stakeholder influences.

Contaminated land and pollution from previous operations and land uses are the immediately obvious issues. The social liabilities may be more nebulous and could include stakeholder agreements invalidated by incorrect process or poor documentation, outstanding compensation payments and incomplete land acquisition and resettlement. These issues can be difficult to quantify as a project risk and difficult to resolve.

Even more indefinite are the perception and relationship liabilities. An actual or perceived history of mistrust, misunderstandings, poor communication, mistreatment, and greed observed in previous company – community interactions, are difficult to gauge in the standard risk matrix. There are some very high profile industry examples where these issues have resulted in ‘stranding’ and ultimately abandonment of the asset.

Question 2: Are all permits and approvals in place?

The mine operator helped stabilise a number of houses in this hilltop village, following extreme rainfall events and landslides

For many operations, this seemingly straightforward question often proves to be one of the most difficult to answer. Often the reviewer is provided with a list of permits and their expiry dates, and a few scanned copies of key approvals – a good place to start. On rare occasions, a recent audit or review by specialist mining industry lawyers is provided.

Legal involvement in the review of permitting status is becoming increasingly important for gauging risks, given:

- The pace of regulatory change in many jurisdictions.

- The complexity and uncertainties in the regulatory regime.

- The need to consider land tenure, mining tenure, mine operation authority, environmental approvals, social and community approval requirements, cultural heritage and the rights of indigenous peoples.

- The increasing occurrence of legal challenges to approvals in a number of jurisdictions.

Environmental specialists and mining engineers can also contribute valuable input to this subject, to make sure all of the components required for the project, or currently in place, are covered by the approval documents, and that conditions of approval are actually achievable.

Question 3: Is the operation in compliance with the law and other relevant standards?

In AMC’s experience, it is surprisingly rare to be provided with authoritative documentation that demonstrates compliance, such as an independent review. A review of a project or operation should consider:

- Company policies, Joint Venture or parent company policies and obligations, and adopted standards.

- Laws, regulations, codes, and guidelines; and other specialist company – government agreements (e.g. Contract of Works, or Mining Development Contract).

- Approval and permit conditions.

- Internal environmental and social management system compliance.

- Equator Principles or other financier requirements.

One particular positive example stands out in the author’s recent experience. At an operation that was reviewed by AMC, environmental, social, and statutory compliance audits were completed alongside and to the same level of detail as financial and corporate accounts auditing, and reported annually. This exemplary practice is, however, the exception, not the rule.

Question 4: Is the project or operation resulting in, or likely to result in, material environmental or social harm?

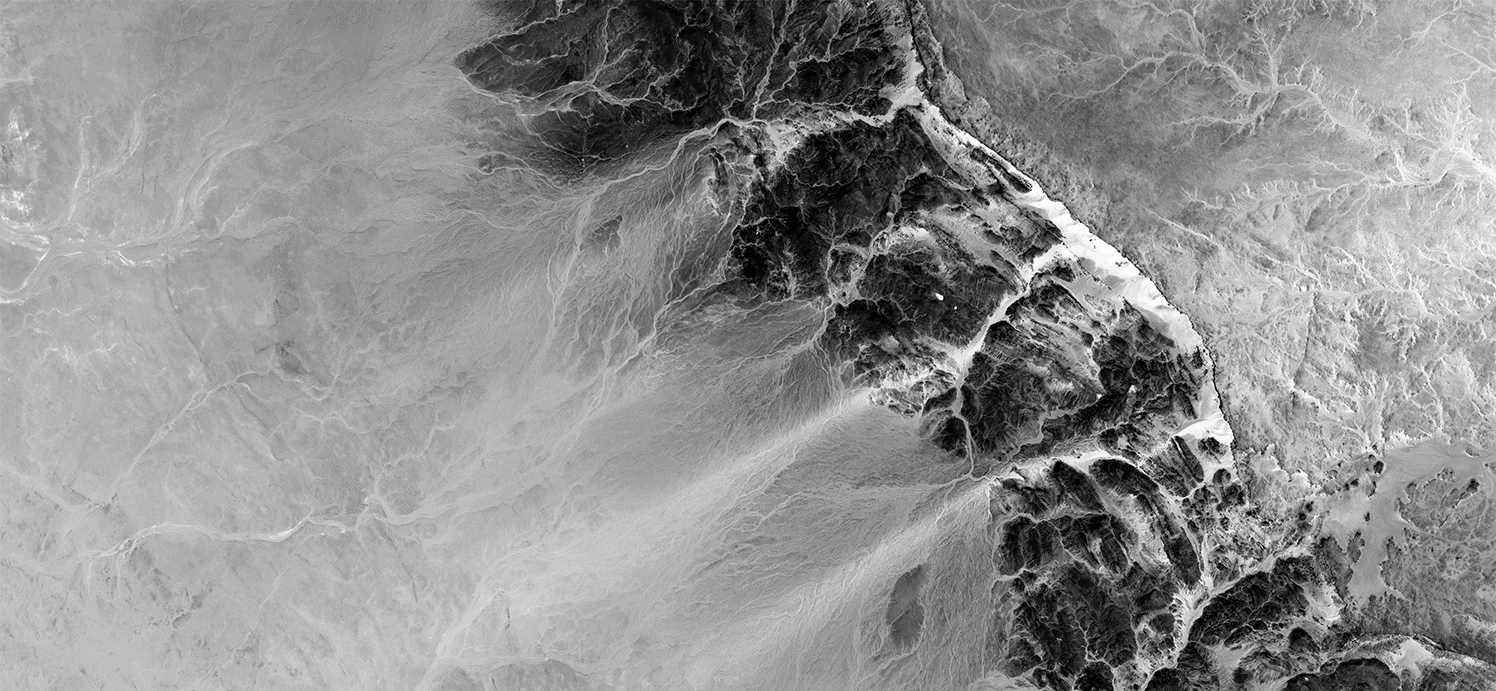

Tailings storage facility in mountainous terrain

The environmental and social interactions, potential impacts, and management measures associated with mining projects can involve a broad range of issues. Mismanagement or neglect in any of these issues can result in significant challenges to the ongoing success of a project or operation.

The range of potential issues varies tremendously, from acid mine drainage, to groundwater impacts, to impacts on stygofauna (the little critters that live in groundwater), to impacts of blasting on neighbouring horse stud farms. From air quality, fly rock, and noise to economic displacement, in-migration, tribal conflicts, and impacts to spiritual and cultural heritage.

Every project is different, and in AMC’s experience, every review brings unexpected issues that need due consideration in the risk profile.

Question 5: Are progressive rehabilitation, closure plans, closure provisions, and security bonds all in place?

Closure provisions and security bonds are usually relatively straightforward questions with definite answers:

- Is the security bond assessment correctly calculated, in accordance with law, up to date, and paid in full?

- Are closure plans properly costed, including social, workforce, and environmental aspects? Are the financial provisions included in the life of mine plans, or is there a similar method of financial provision?

Progressive rehabilitation and mine closure planning needs to be assessed in conjunction with closure provisions and security bonds. An operation with easily manageable waste rock and tailings, abundant good quality soils and favourable climate, with demonstrated success in continuous rehabilitation signed off by the regulator, is relatively easily assessed as a lower risk closure prospect.

On the other hand, a mine with extensive acid drainage, poor soils resources, challenging climatic conditions, inexperienced regulators, and no demonstrated rehabilitation success, suggests material uncertainty in closure cost provisions and accuracy of security bond.

Conclusions

The ‘basic five’ provides a starting point for identifying potential approval, environmental and social risks to be considered in an investment decision. Evaluating the risks, together with identification of risk mitigation measures are the next steps in the process, as part of the overall evaluation of risks in the due diligence process.

Peter Allen

[1] Ernst and Young, 2015. “Tomorrow’s Investment Rules 2.0 Emerging risk and stranded assets have investors looking for more from nonfinancial reporting”.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights