Editorial May 2020: Hard times and low grades

Hard times and low grades make for efficient mines. The COVID-19 crisis is driving most forms of business to improve efficiencies, transform operating practices and learn what really can be done when employees are working and helping children learn from home. There will be an opportunity to lock in much of the improved productivity and the world will not revert to its former condition. Countries that can limit the spread of the virus today will have to maintain permanent protocols to prevent a breakout. The availability of a vaccine might change this, but no coronavirus vaccine has ever been developed. Other global forces will be significant for the minerals industry. To understand them, two examples from the past may be helpful.

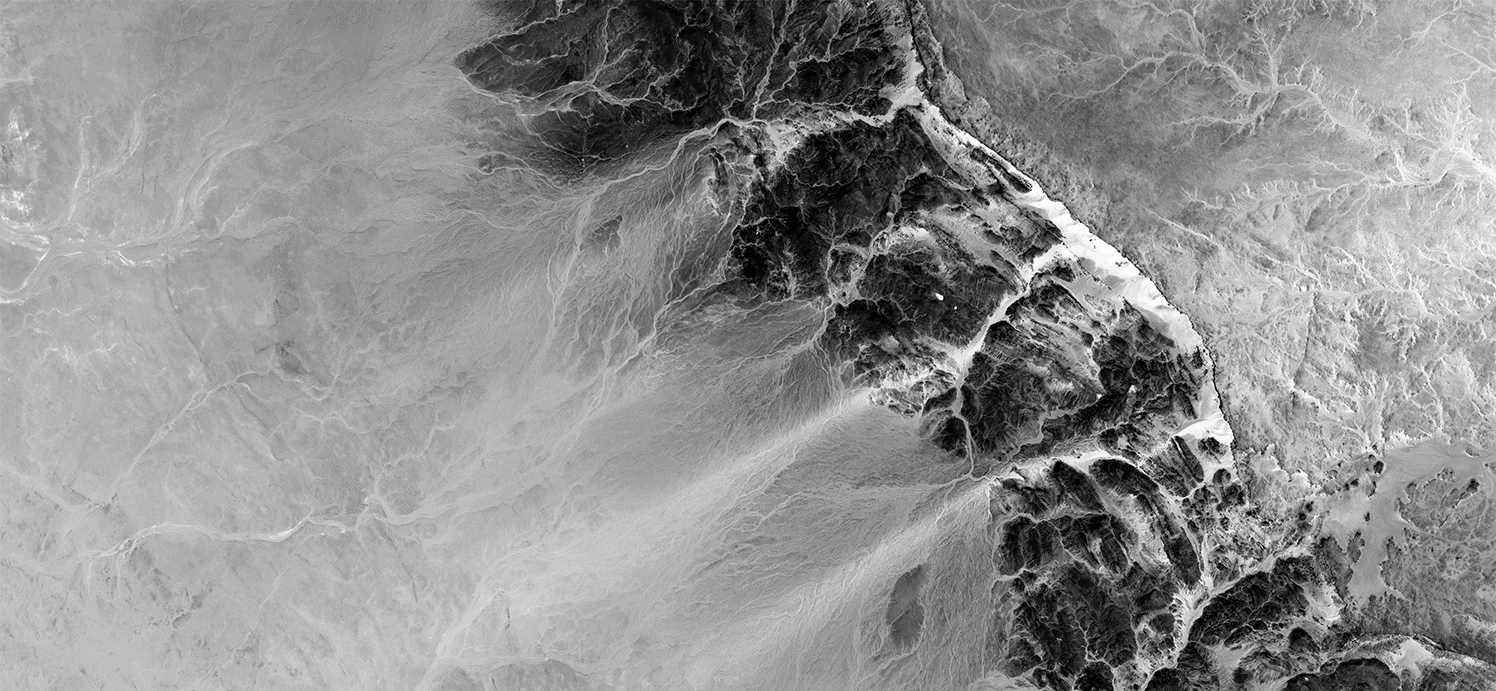

Tasmanian smelters, Zeehan. Source: Libraries Tasmania

Hard times and low grades make for efficient mines. The COVID-19 crisis is driving most forms of business to improve efficiencies, transform operating practices and learn what really can be done when employees are working and helping children learn from home. There will be an opportunity to lock in much of the improved productivity and the world will not revert to its former condition. Countries that can limit the spread of the virus today will have to maintain permanent protocols to prevent a breakout. The availability of a vaccine might change this, but no coronavirus vaccine has ever been developed. Other global forces will be significant for the minerals industry. To understand them, two examples from the past may be helpful.

Tasmanian smelters, Zeehan. Source: Libraries Tasmania

In 1939 Japan’s strategic supplies of rubber, iron, and oil were grossly inadequate and it didn’t have any allies in the region. It was considered a rogue state and subject to trade embargos. Japan desperately needed resources, and there were only two places to get them: Siberia and the South Pacific. They tried in Siberia but lost the Battles of Khalkhin Gol. The next step was to attack Pearl Harbor, Singapore, Hong Kong, the Philippines, and Malaya, and we know how that ended.

The zinc story tells us that even in the crisis of war, it can take several years to change supply and demand patterns. But certainty about demand and price, guaranteed by governments, enables new technologies and new mine developments. The story of Japan tells us that governments will do what becomes politically necessary, even if it is fraught with existential peril.

The threat of another virus outbreak and its political implications will lead to permanent changes in supply and demand, with each country seeking to source more raw materials locally—or shorten supply chains from secure neighbours if raw materials not available locally. Trade barriers will grow, and two blocs may emerge, within and without the Chinese sphere of influence. The list of minerals considered to be strategic will increase substantially, with no country wanting to be deprived of supply when borders close or relations sour. The world of “Davos Man”, the politically connected business and investor elite, advocates of free trade, free flow of capital, and open markets, is in full retreat.

Mineral prices will respond to these changes in supply and demand. The prices of strategic minerals will rise considerably. Deposits that are already known but are sub-economic will become viable.

In 1939 Japan’s strategic supplies of rubber, iron, and oil were grossly inadequate and it didn’t have any allies in the region. It was considered a rogue state and subject to trade embargos. Japan desperately needed resources, and there were only two places to get them: Siberia and the South Pacific. They tried in Siberia but lost the Battles of Khalkhin Gol. The next step was to attack Pearl Harbor, Singapore, Hong Kong, the Philippines, and Malaya, and we know how that ended.

The zinc story tells us that even in the crisis of war, it can take several years to change supply and demand patterns. But certainty about demand and price, guaranteed by governments, enables new technologies and new mine developments. The story of Japan tells us that governments will do what becomes politically necessary, even if it is fraught with existential peril.

The threat of another virus outbreak and its political implications will lead to permanent changes in supply and demand, with each country seeking to source more raw materials locally—or shorten supply chains from secure neighbours if raw materials not available locally. Trade barriers will grow, and two blocs may emerge, within and without the Chinese sphere of influence. The list of minerals considered to be strategic will increase substantially, with no country wanting to be deprived of supply when borders close or relations sour. The world of “Davos Man”, the politically connected business and investor elite, advocates of free trade, free flow of capital, and open markets, is in full retreat.

Mineral prices will respond to these changes in supply and demand. The prices of strategic minerals will rise considerably. Deposits that are already known but are sub-economic will become viable.

At an operational level, aircraft will be more expensive to operate. Some estimates say 50% more, but it could be even higher. The cost of disinfecting between flights, slower turnaround, spacing out of seats and reduced demand will ensure this. Will this tip the balance from fly in – fly out operations to the return of some residential mine sites and more remote operations centres? Other forces are at work in that direction. People are quickly learning to use digital interaction for business, education and social purposes. People living on remote sites will have access to telemedicine, online learning, online shopping and even digital sports. The new generation is more comfortable using a flight simulator app than learning to fly a real aeroplane and can choose from endless online games with global participants. People offsite will be able to inspect and interrogate operational data. So yes, residential mine sites are coming back, but not as we knew them in the 20th Century.

At an operational level, aircraft will be more expensive to operate. Some estimates say 50% more, but it could be even higher. The cost of disinfecting between flights, slower turnaround, spacing out of seats and reduced demand will ensure this. Will this tip the balance from fly in – fly out operations to the return of some residential mine sites and more remote operations centres? Other forces are at work in that direction. People are quickly learning to use digital interaction for business, education and social purposes. People living on remote sites will have access to telemedicine, online learning, online shopping and even digital sports. The new generation is more comfortable using a flight simulator app than learning to fly a real aeroplane and can choose from endless online games with global participants. People offsite will be able to inspect and interrogate operational data. So yes, residential mine sites are coming back, but not as we knew them in the 20th Century.

The challenge

Remote operations centres will become more common, though many operations cannot be automated in the way that large iron ore mines, for example, can be. Operators and maintainers will still be needed, but many other functions will migrate offsite. Administration, planning, warehouse management and other functions will work perfectly well offsite. In other than Arctic locations, the new look residential mine will have a core of “local” employees and their families, with local support services and a strong offsite function. This will require careful development because business improvement, for example, is a face-to-face function with operators that usually only succeeds with direct human interaction but might be amenable to some form of immersive technology.

What are the implications for the environment? There will be many more mines in North America, Australia and Europe producing strategic minerals. These will be small or low-grade mines that were not previously economic, so will be more resource intensive than former sources. However, they may operate under stricter environmental constraints than former sources in Asia, Africa or South America. Aircraft traffic will be greatly diminished, reducing fuel usage and emissions. Product stewardship, being able to trace the path of products back to their source, will become a strategic necessity.

Management practices will change as the balance of onsite and offsite activity changes. Digital infrastructure will be highly developed. The experience of lockdown will show people that women and men are equally capable of working in all the roles required, while sharing family responsibilities.

How confident can we be about these changes? Not greatly, but there will be changes, many of them for the better, many unpredictable today. Some serious scenario planning is called for.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights