Break-even is Broken: Learn How to Align Your Break-even Grades With Company Goals

Sometimes what we are taught is not right anymore (if it ever was)

“A 0.1 g/t gold grade error in a break-even grade can make half of an ore reserve of zero value”

The lead author’s father was taught at school that the “nucleus of an atom was the smallest indivisible piece of matter”. It was then an undisputable truth. We now know of course about quarks, muons and neutrinos. In this article we invite the reader to reconsider what they were taught on how break-even grades should be calculated and used, and how cut-off grades are selected for use in mining studies and ore reserves estimation.

The authors contend that the way that the base and precious metals mining industry uses break-even grades is not consistent with the stated objectives of the mining company, and therefore if not plainly wrong, then at least deeply flawed and subject to so many sources of error that value is almost guaranteed to be destroyed.

Like using Newtonian physics in a quantum physics world, the way the majority of the mining industry calculates ore reserves with a break-even equation, we contend, is no longer appropriate – it is broken. And it is a major contributor to the underlying problems with the financial returns of the mining industry. As will be shown in the case study in this article, an error of just 0.1 g/t in the break-even cut-off grade of a large-scale open-pit gold mine can result in 50% to 60% of the ore reserve having zero value. And the authors contend that it is more common than not that mines have ore reserves with this scale of error.

However, while the current process that is commonly used to estimate an ore reserve is deeply flawed, the resulting declared ore reserve is not necessarily invalid. The JORC Code only requires that the ore reserve is shown to be “economically mineable” (JORC, 2012). The JORC Code does not say anything about an ore reserve having to exclude substantial tonnages that are negative in value and will lose money, as long as the total ore reserve is economically mineable. But it is implied in the JORC Code that the ore reserves quoted are what will be mined and processed by the mining company.

The Purpose of a Cut-Off Grade

Mining companies will generally state their goals, purpose or mission to be something similar to:

- “create long-term shareholder value” (BHPBillition, 2015)

- “deliver strong and sustainable shareholder returns” (Rio Tinto, 2015)

- “deliver superior returns” (Newcrest 2015)

This can only be achieved by a selected combination of share price growth and dividends.

Given that the cut-off grade is the key decision variable determining what is processed in a mine (and what is not; with ore processing being the main value generating function of a mining company), then the purpose of the cut-off grade should be to enable the mining company to achieve these previous stated overall goals, i.e. creating shareholder value from the mine in which the cut-off grade is being applied. If the cut-off grade is not doing this, then the company cannot achieve its stated aims.

The Break-Even Grade

The cut-off grade that is used by most mining companies for the “process” / ”do not process” decision, rightly or wrongly, is the break-even cut-off grade.

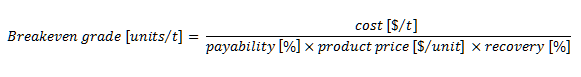

The break-even grade is defined as the grade at which revenue obtained is equal to the cost of producing that revenue. The simple break-even formula to determine this is:

Although the formula is simple, many companies spend a lot of time and energy arguing over what costs should be included.

In addition, what is commonly not recognized, or is dismissed as not particularly important, is that the recovery is usually a function of grade, and that both the cost and the payability can also be a function of grade.

So the simple formula is in fact not so simple after all.

Also, it is important to note that this definition of the cut-off grade being used for estimation of ore reserves and the planning of the mine (the break-even cut-off grade) is not the same as the stated objective of the mining company – to deliver shareholder value. Thus the use of a break-even cut-off grade will lead to mine plans that are almost guaranteed to not deliver the company’s stated goals.

This then begs the question of why are companies using a break-even cut-off? The authors suggest that they are simply oblivious to the effects of what they are doing.

The Marginal Tonnage Issue in Ore Reserves

Although it is not often appreciated, a key feature of many stated ore reserves estimates is that a significant portion of the ore reserves tonnage is marginal in value.

Whilst this is well known and understood by mining engineers heavily involved in the preparation of ore reserve estimates and in strategic long-term planning, it has become apparent to the authors that the vast majority of mining executives do not understand how marginal much of their company’s ore reserves actually are – especially those executives from a non-technical background.

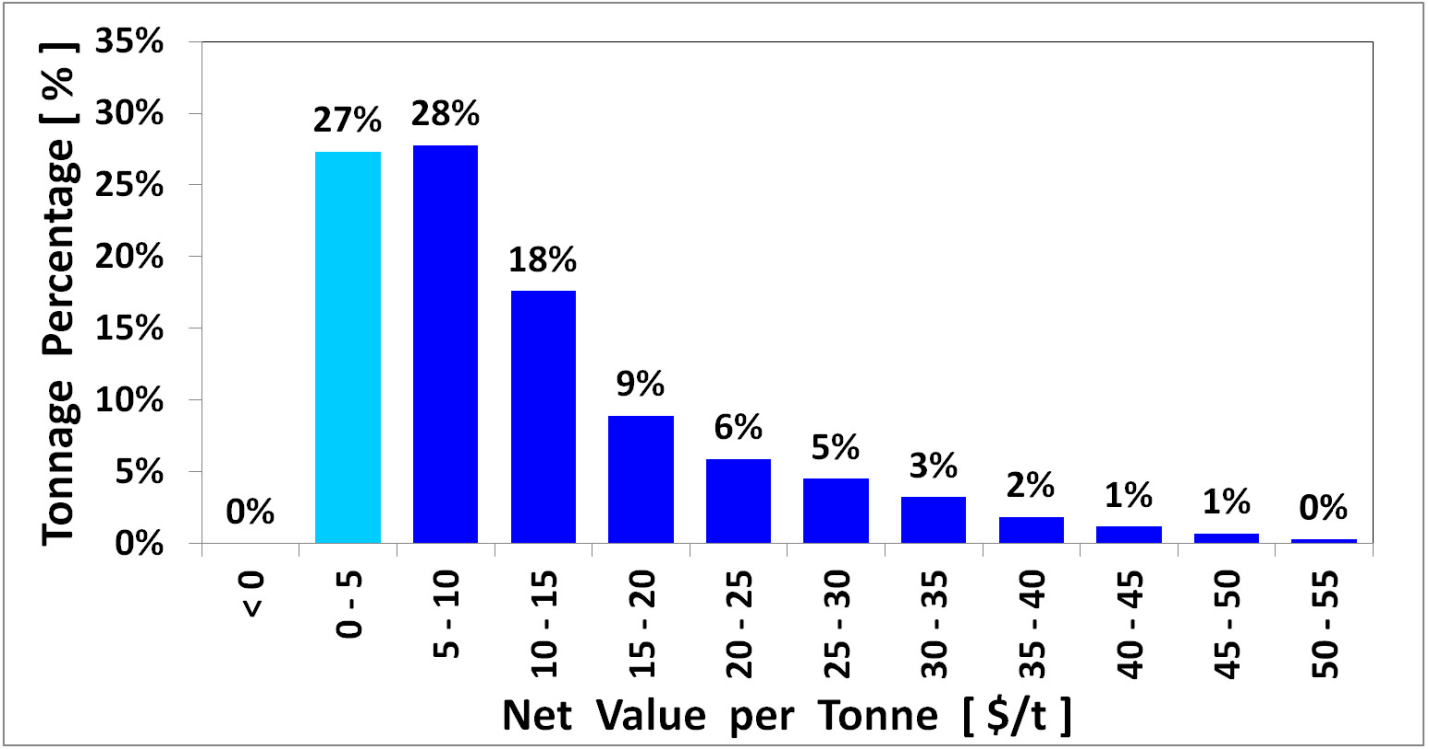

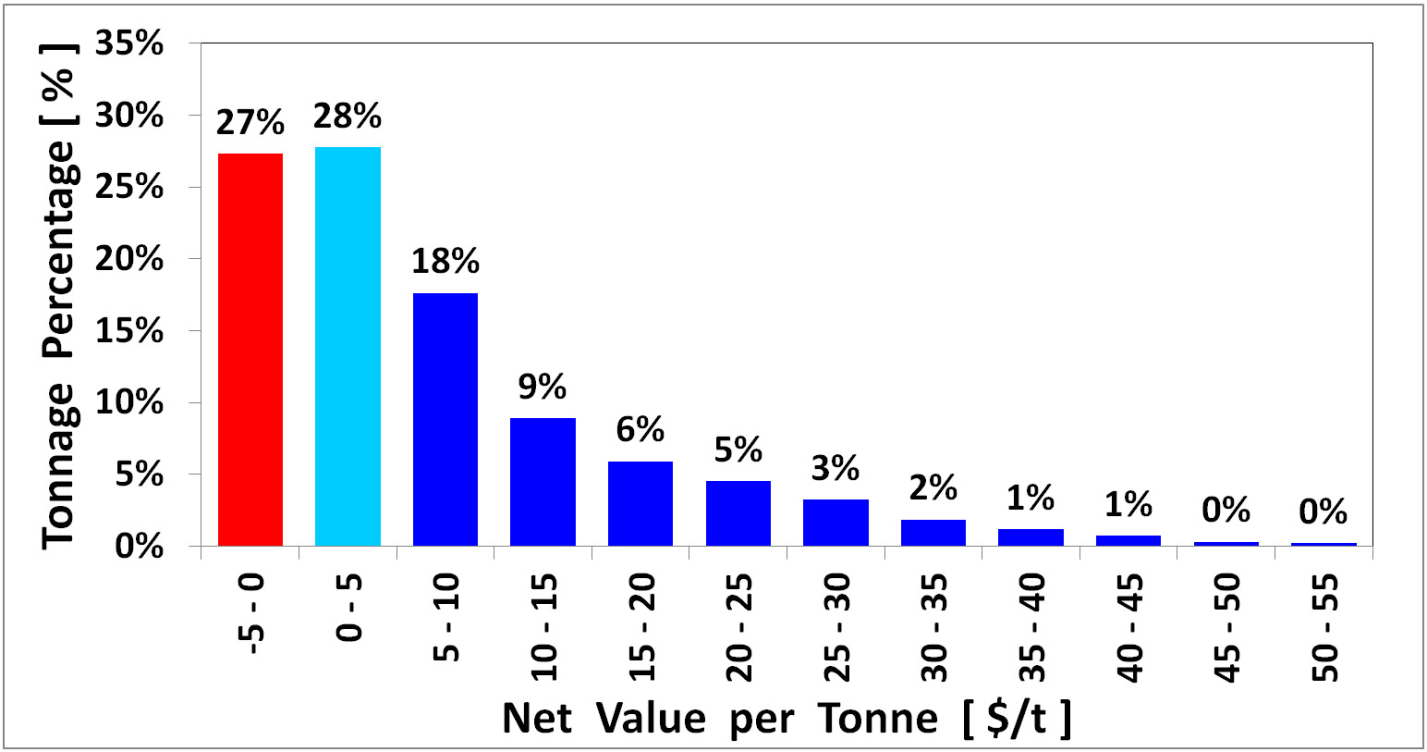

Figure 1 presents an example of the distribution of an ore reserve tonnage by value for an actual open-pit copper-gold mine (Mine A). The distribution shown is typical of many orebodies when a break-even cut-off value (grade) is used to estimate the ore reserves. A significant portion of the ore reserve tonnage is of low or marginal value.

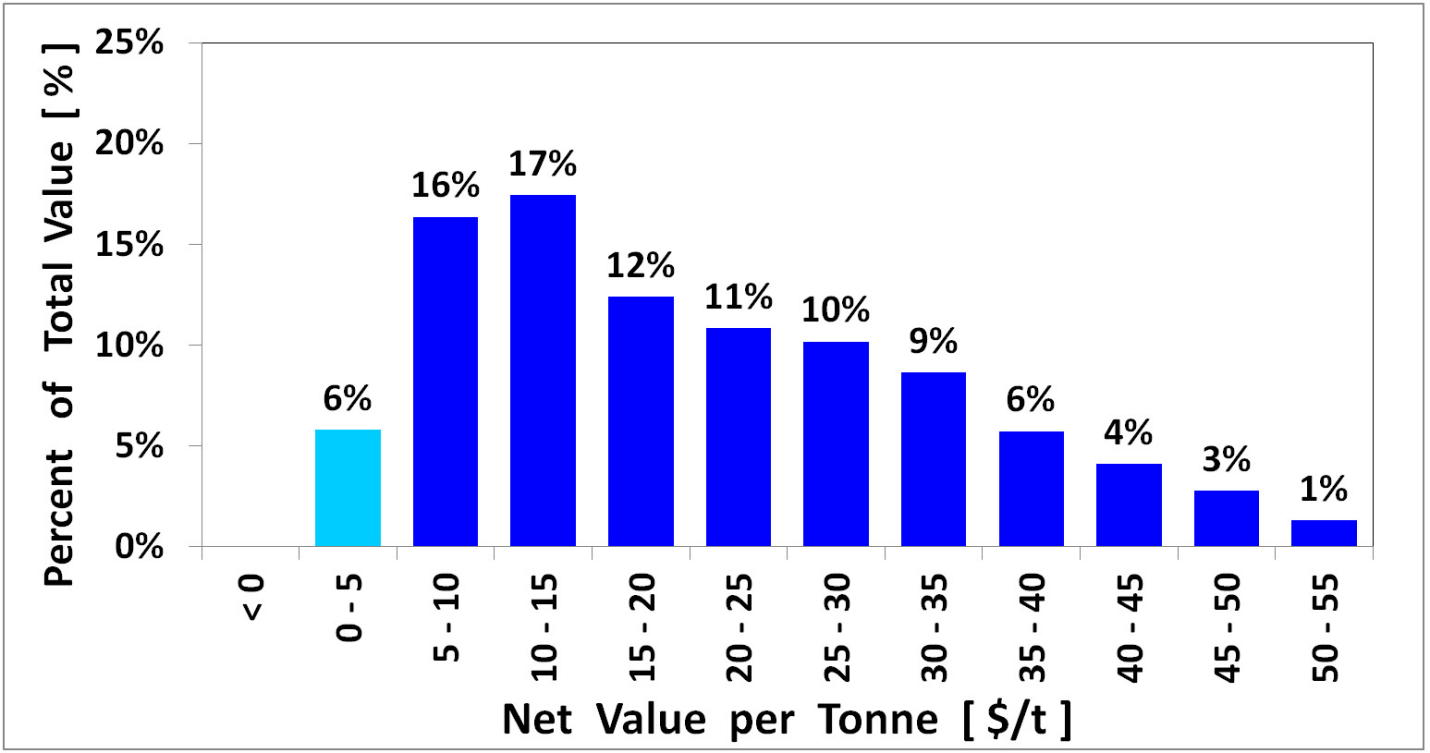

The distribution of total value for this ore reserves estimate is shown in Figure 2. The grades of the material have been converted to equivalent net values expressed in dollars per tonne.

In this particular distribution, an interesting symmetry was present. The bottom 27% of the ore reserve by tonnage held 6% of the value. The top 27% of the ore reserve held 60% of the value – ten times the value for the same tonnage. In effect, a lot of the ore reserve is being mined and processed for little more than “practice”.

The Effect of Small Errors in the Break-even Cut-off Grade on Ore Reserve Value

Using the cut-off value – tonnage distribution for Mine A, it can be seen that a marginal break-even cut-off grade for the ore reserves estimate can have significant downside effect if there is an error in calculating the break-even cut-off grade. Such an error would result in a significant portion of the stated ore reserves becoming negative in value.

If the error is equivalent to $5/t in value (be it a cost or revenue error or a combination of both), then the distribution shown in Figure 1 would be modified to a value distribution as shown in Figure 3. In total, 27% of the ore reserve tonnage is now in the –$5/t to $0/t value bin and a similar tonnage is in the $0/t to +$5/t value bin. A total of 55% of the ore reserve now has effectively zero value.

The $0/t to +$5/t value bin tonnes should be contributing to the capital payback of the project and adding to the value of the total project. Instead it is now “supporting” the loss of the –$5/t to $0/t value bin tonnage.

To understand how easy it is to have a $5/t error in the cut-off grade, at the current Australian gold price (at the time of writing) of A$1,640/oz, a $5/t error is induced by any error that changes the calculated cut-off grade by 0.095 g/t – let’s round it up to 0.1 g/t.

So an error of 0.1 g/t in the break-even cut-off grade calculation of a large-scale low-grade open-pit gold mine (for which the previously discussed value distribution is typical) will result in 50% to 60% of the ore reserve having zero value. This is quite disturbing to realize, and is generally unappreciated within the industry.

The authors refer to these ore reserves as “negative geared”, which are discussed in more detail in a recent AusIMM Project Evaluation conference paper (Poniewierski, 2016).

The Two Most Common Errors

The two most common errors that the authors have seen in calculation of break-even cut-off grade – errors that lead to negative geared ore reserves, are:

(i) The fixed recovery error, and

(ii) Omission of sustaining capital costs.

The fixed recovery error refers to the use of a constant fixed recovery percentage for all head grades down to the break-even grade. For example, consider a mine with a gold head grade of 2.2 g/t that has been evaluated to have a recovery of 94% at the 2.2 g/t head grade. If the 94% recovery value is used to determine a break-even grade, for an example the authors are familiar with (Poniewierski, 2016), the break-even grade would be 0.4 g/t, which implies a tails grade of 0.02 g/t. This is a tails grade so low that, to the authors’ knowledge, no operating gold mine has ever achieved it. At a head grade of 2.2 g/t, a recovery of 94% implies a tails grade of 0.13 g/t.

If it is recognized that the recovery varies with head grade, and a fixed tails grade is used to assess the recovery instead of a fixed percentage recovery, then the same cost and price conditions that resulted in a break-even cut-off grade of 0.4 g/t for the fixed percentage recovery, would now result in a break-even cut-off grade of 0.5 g/t. This is a difference of 0.1 g/t – sufficient to make 50% to 60% of the ore reserve previously calculated with the fixed percentage recovery of zero value.

An examination of JORC Table 1 releases shows that a large percentage of ore reserves are using the fixed recovery approach in the break-even cut-off grade calculation.

The second item, the omission of sustaining capital costs can result in a significant under estimation of the true costs, and therefore a significant underestimation of the break-even cut-off grade.

Hall (2014) discusses the sustaining capital in detail. Sustaining capital is expenditure that maintains existing capabilities, as opposed to “project capital” that is used to buy capability (or capacity).

For maintaining existing capital items, there is no conceptual difference between replacing an oil filter every 50 hours (an operating cost) and replacing a truck engine every 16,000 hours (a capital cost) or even replacing a truck every 50,000 hours (a capital cost). Sustaining capital is therefore conceptually a ‘lumpy’ irregular expense that is classified by accountants as capital rather than operating costs purely by virtue of the spending pattern – not the underlying nature of the cost. By capitalizing these irregular expenses, accountants are able to use depreciation to more evenly spread these ‘lumpy’ costs out over the useful life of the equipment being maintained. As such sustaining capital needs to be included in the cut-off grade calculation.

Some examples of sustaining capital costs that should be included are discussed in both Poniewierski (2016) and Hall (2014).

How should break even be calculated?

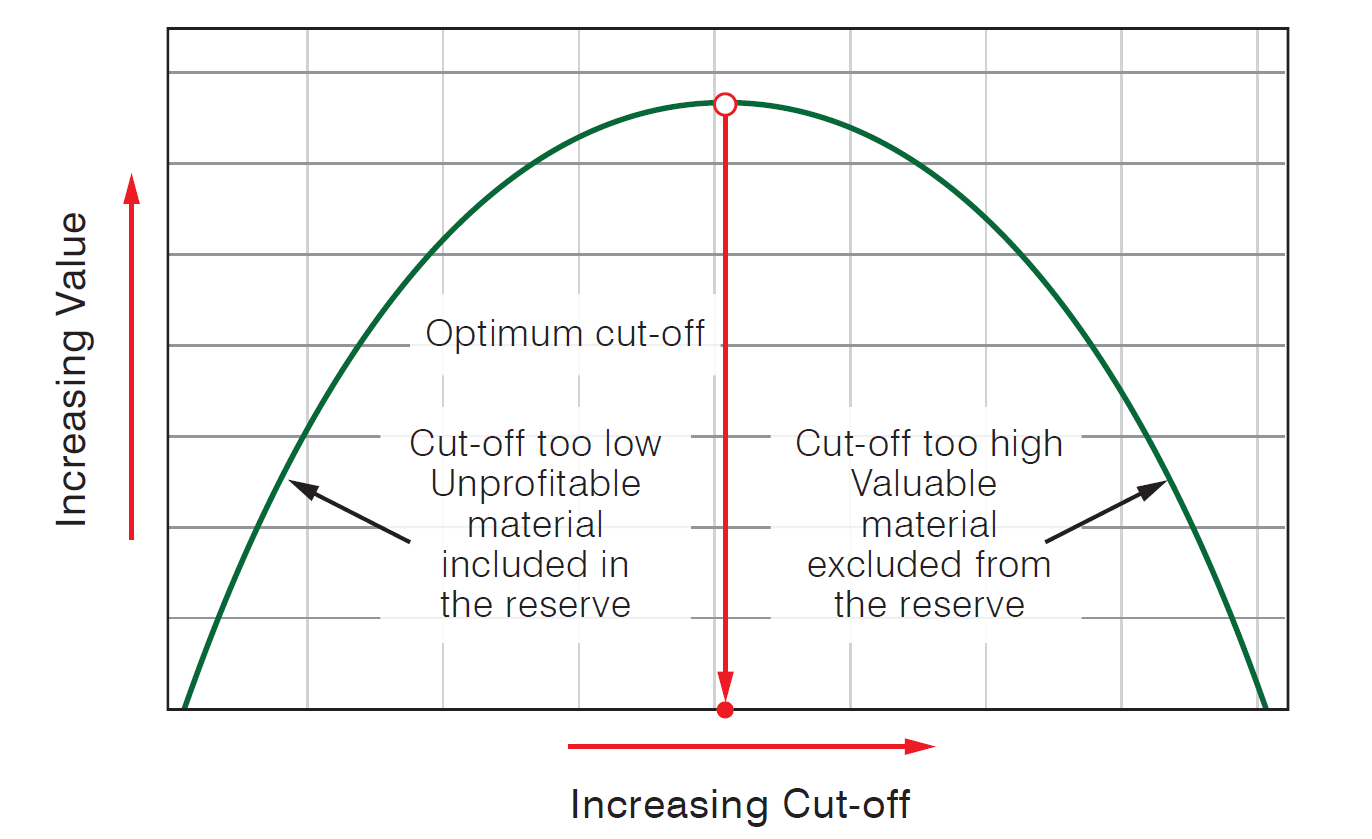

The authors contend that the only true method of evaluating a correct break-even cut-off grade is to undertake a set of scenarios with varying cut-off grades and varying production rates. If these scenarios are evaluated in a financial model that accurately reflects the costs of each scenario and the undiscounted cash flows are graphed as shown in Figure 4 (where in this case the y-axis of ‘increasing value’ is the project total undiscounted cash flow), then the cut-off grade that results in the largest undiscounted cash flow is the cut-off grade that is the true break-even cut-off grade.

By definition, a cut-off grade less than the identified peak cash flow cut-off grade and that results in a lower total cash flow, by definition must include material that is losing value.

Should we be using break-even at all?

The authors also contend that we should not be using the break-even grade at all. If the time value of money is recognized, then a grade higher than the calculated break-even grade will usually be found to be a cut-off grade that maximizes Net Present Value (for a fixed selected cut-off grade value) – as discussed in Hall and de Vries (2003) and Hall (2014). In this case, for the y-axis shown in Figure 4, the ‘increasing value’ is the project total net present value (discounted cash flows).

Further refinement is possible resulting in a cut-off grade policy of varying cut-off grades over the life of mine that will result in increasing the Net Present Value – as discussed by Lane (1997), Whittle (2015) and King (2001)

Sub-Grading

The authors recognize that there is a perception in the mining industry that increasing the cut-off grade above the currently used and publicized break-even cut-off grade leads to accusations of “high-grading”. The term generally has a negative pejorative connotation and is always an “accusation” that the mined grade is higher than it should be, picking the “eyes” out of the resource, sterilizing “ore”, and thereby destroying value.

If that’s what increasing the cut-off grade is really doing, then it is indeed a bad thing. But this begs the question of what the grade “should be”! Presumably, it should be the grade that delivers what the company’s goals are – providing shareholder returns and value.

In numerous strategy optimization studies conducted, the authors have never found an operation “high-grading” above the grade that maximizes cash generation. Many, however, are “sub-grading”; mining and treating grades that are substantially lower than the cash maximization grade and using higher grade ores to subsidize loss-making “ore” tonnages.

The authors suggest that mining with a properly-engineered mine plan at the grade that delivers the company’s goals is “right-grading”. Typical plans are therefore “sub-grading”, which should be just as pejorative a term as “high-grading”. To a “sub-grader”, “right-grading” will look like high-grading. But what right-grading has eliminated from the sub-grader’s mine plan is material that’s actually destroying value, which should not have been in the plan in the first place. It is not destroying value by sterilizing value-adding material, the feared outcome of “high-grading”.

Mining is a business, and a business does no-one any favours by setting itself up for failure.

In conclusion

There is a fundamental problem in the mining industry with the use of the break-even cut-off grade – a problem that is exacerbating the poor financial returns of the industry. We leave the reader with a final thought that should be the new mantra on cut-off grades:

“Cut-off grade should be an outcome of a mining study that has been undertaken to meet the company’s stated value goals. Cut-off grade should not be a predefined input into such a study, as this will guarantee that the company’s value goals will not be met.”

References

BHPBillition, 2015. “Resourcing global growth”, Annual Report, 2015.

Hall, B, 2014. Cut-off Grades and Optimizing the Strategic Mine Plan, The Australasian Institute of Mining and Metallurgy (Melbourne), Spectrum Series 20, 311 p.

Hall, BE & de Vries, JC, 2003. Quantifying the economic risk of suboptimal mine plans and strategies. In AusIMM Managing Risk in Mining Projects Conference, Sydney, Australia, September 2003. pp191–200.

JORC, 2012. Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code) [online]. Available from: <http://www.jorc.org> (The Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia).

King, B, 2001. Optimal Mine Scheduling, in Mineral Resource and Ore Reserve Estimation – The AusIMM Guide to Good Practice (Ed: A C Edwards), pp451–458 (The Australasian Institute of Mining and Metallurgy: Melbourne).

Lane, K F, 1997. The Economic Definition of Ore. 2nd Edition, Mining Journal Books, London.

Newcrest, 2015. Newcrest “Our Values” webpage, http://www.newcrest.com.au/careers/work-with-newcrest/careers-our-values (accessed 19 March 2015).

Poniewierski, J, 2016, “Negatively Geared Ore Reserves – A Major Peril of the Break-even Cut-off Grade”, Proc. AusIMM Project Evaluation Conference, Adelaide, 8-9 March 2016. pp236-247.

Rio Tinto, 2015. “About Rio Tinto” web page, http://www.riotinto.com/aboutus/about-rio-tinto-5004.aspx (accessed 19 March 2015)

Whittle, G, 2015. Whittle Optimization – The Money Mining Methodology and Its Impact on Ore Reserves, in Mineral Resource and Ore Reserve Estimation, The AusIMM Guide to Good Practice, 2nd Edition, Monograph 30, pp525 – 528

FIGURES

This article originally appeared in the June 2016 edition of The AusIMM Bulletin.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights