The best operational improvement – Having the right strategy

Mining companies are committing enormous organizational effort and resources into identifying and implementing operating cost and productivity improvement initiatives. Often, these initiatives add incremental value, indeed impacting the bottom line.

However, there appears to be less industry focus or recognition of the significant value potential coinciding with the identification of the right operating strategy. In AMC’s experience the right strategy can deliver value, in orders of magnitude, larger than incremental improvement initiatives.

As strategic analysis is not usually an ongoing operational activity, focus and resourcing of this activity can sometimes be neglected. The outcome being that strategic opportunities can go unrecognized and ultimately unrealized.

As market conditions change and an orebody is depleted, what might have been an appropriate strategy in the past, may no longer be the right strategy now or for the future. Fundamental strategic value drivers that should be considered on a regular basis include, but are not limited to:

- Mining method and materials handling system.

- Selective mining unit (SMU) and the benefits of selective mining.

- Mine design (including the size of mine) and extraction sequencing.

- Mining rate.

- Cut-off grade strategy.

- Processing method(s) and throughput rate.

- Ore blending and plant feed strategies.

- Product specifications.

- Integration with other operations.

- Logistics.

Ideally these drivers are optimized on a holistic basis per the orebody and corporate objectives, although legitimate operational constraints can restrict the number of drivers able to be considered. These drivers are discussed in detail in Hall (2014).

An indication of the value that can be obtained from evaluation of operating strategies is demonstrated below in two case studies AMC has recently completed.

Case Study 1 – Iron Ore

Value Improvement:

- 28% increase in average annual free cash flow.

- 22% increase in the Net Present Value (NPV) of the life-of-mine plan.

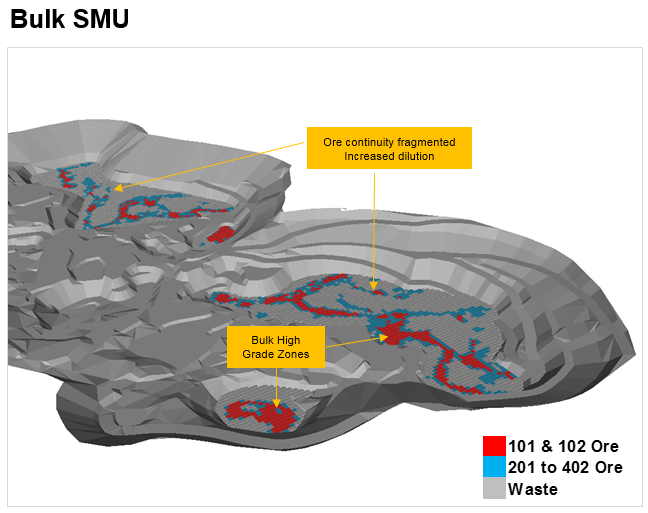

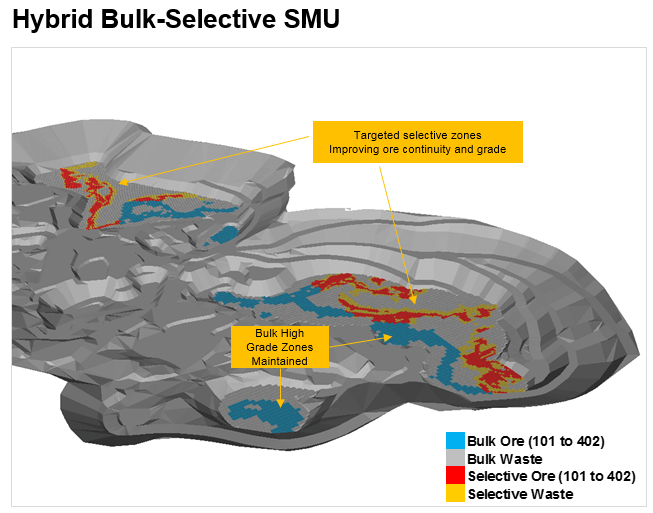

A mature mining operation using large-scale bulk mining methods beneficiating ore for delivery of a premium iron ore product. The bulk mining approach and resulting SMU were investigated testing the orebody response to a more selective mining approach.

The strategic evaluation identified that a hybrid bulk-selective mining approach (Figure 1) enabled:

- Dilution to be reduced, allowing diluting material to be replaced with additional near cut-off grade material increasing the overall iron units processed.

- A reduction in cut-off grade, increasing life-of-mine ore inventory 11%, whilst maintaining product grade specifications.

- Use of latent processing capacity for an additional six years, maximizing plant throughput and bringing forward revenue.

- Mining cost minimized by targeting bulk mineralization zones with low-cost bulk methods, and restricting higher-cost selective mining to mineralized zones on hanging-wall and footwall contacts.

- Minimal capital expenditure.

Case Study 2 – Copper

Value Improvement:

- 16% increase in Resource utilization.

- Increase of mine life by 25 years.

- 18% increase in operating cash flow and 6% increase in discounted cash flow.

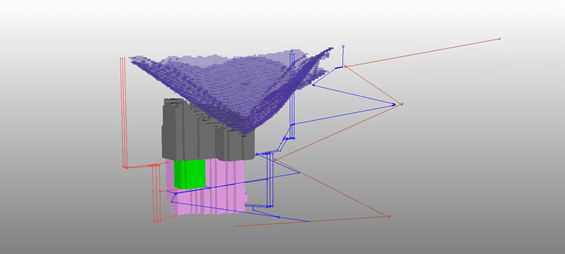

A large-scale low grade porphyry copper deposit planned to be mined as an open pit over 23 years. The mining method and extraction sequence was investigated testing alternative approaches to mine the Resource.

The strategic evaluation identified that an integrated open pit and underground operation (Figure 2) enabled:

- High strip ratio open pit mining could be replaced with higher margin underground mining.

- An 8% increase in head grade over the mine life.

- Staged open pit and underground mining brings forward higher margin material.

- Deferral of capital, with the transition to underground mining optimized, increased Internal Rate of Return (IRR).

- A similar metal production profile achieved with a reduced processing throughput rate.

- Stockpiled material from open pit mining supplementing plant feed during ramp-up of underground mining maintains operating cash flow.

- Increased recovery of the resource, extending the mine life.

Conclusion

Mining companies are committing enormous organizational effort and resources into identifying and implementing operating cost and productivity improvement initiatives. Often, these initiatives add incremental value, indeed impacting the bottom line.

However, there appears to be less industry focus or recognition of the significant value potential coinciding with the identification of operating strategies (relevant to market conditions and the orebody) that can provide value, in orders of magnitude, larger than incremental improvements.

AMC are experts in demonstrating and realizing value through optimized mining strategies considering key value drivers, using leading industry processes and software. As an independent consultancy, we adopt the most appropriate approach to each operation or business, ensuring that maximum value is identified.

References

Hall, B, 2014. Cut-off Grades and Optimizing the Strategic Mine Plan, The Australasian Institute of Mining and Metallurgy (Melbourne), Spectrum Series 20.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights