Ore Reserve estimates and changes in Commodity Price – A survival guide

Volatile commodity prices present particular challenges for Competent Persons and companies in fulfilling their obligation to keep the market informed.

One of the hot-topics from last year’s Monograph 30 Roadshows, guide to good practice, was the influence of recent swings in commodity prices. In extreme cases people asked “Does the Ore Reserve estimate still exist?” and we heard a paper from Michael Creech where he presented a study of mine closures that had on average 20 to 30 years production in their Ore Reserves prior to closure.

This issue can place the Competent Person front and centre to the Chief Executive Officer (CEO), needing to summarise thousands of hours of technical work clearly and concisely, to either provide reassurance or prompt the decision to publish a re-estimation (a new “Public Report”). As part of the annual process of renewing consent each year in annual reports, the Competent Person may also need to have a difficult conversation on the validity of the Ore Reserve.

For the CEO it’s important to understand that a re-estimation of the Ore Reserve with a different price can take some time. If appropriate sensitivity testing is done at the study level and in each revision of the Ore Reserve, then the CEO and the market can be informed of the valid ranges and when a new Ore Reserve estimate is required.

Introduction

Due to fluctuations in commodity prices over the last year and a half, and some mine closures when companies have still been reporting an Ore Reserve, frequently asked questions have arisen:

- As a Competent Person, how can I be confident of the price I am using?

- When does a change in price trigger a new Ore Reserve?

- What does the CEO and the market need to know?

- How does the Competent Person defend the Ore Reserve when prices change?

- What are some good practices around price estimation and sensitivity to test materiality?

- What happens to an operating mine when the price varies materially from the long term forecast?

Price

A discussion of Price is required in JORC Table 1, Section 4 Estimation and Reporting of Ore Reserves under the Criteria “Revenue factor” and “Market Assessment”. It is one of a number of non-resource modifying factors and can be difficult to predict.

The Competent Person needs to be satisfied with the price supplied. If the long-term real price is significantly above the spot then it may be time to ask for additional information. Ideally companies should have an official process; an example could be a Resource and Reserve Committee that incorporates the price forecasting team. Good practices in obtaining of price data include:

- Obtain a current long term real price from an independent commodity forecasting organization.

- Obtain a current long term real price from the finance department. Be sure to ask clearly for the long-term real price and currency.

- Benchmark and perform statistics on the the price against consensus forecasts, understand the ranges and historical trends.

- Along with other modifying factors, have the person who supplied the number complete a consent form, noting their qualifications, role, and that they are responsible for the factor and the source of documentation. It helps them understand and support the process.

- Ensure the CEO and other key business leader’s sign-off on the modifying factors being used. During this process it’s helpful to outline the timeline, process and sensitivity. This step will minimize late revision requests and re-work.

Communicating the sensitivity

It is important to know how sensitive the operation is to fluctuations in long term price, this way the Competent Person can communicate the price changes to the organization. If the price change is likely to be material, the Competent Person should mention this in the Table 1, Section 4 appendices to Public Report. The Competent Person, for example could mention the sensitivity work done and where the trigger is, for example: “The sensitivity analysis of the Ore Reserves tonnage to price fluctuations shows reasonable stability of tonnage out to a reduction in price of 30% from the long-term real forecast”. Price changes in spot commonly do not have any bearing because of the use of long-term price forecasts, but not everyone is aware of this. It is important for the Competent Person to have the sensitivity work ready to answer questions on this topic.

Good practice to communicate the sensitivity includes:

- A sensitivity analysis should be done on an appropriate range.

- Include sensitivity results in Public Reports.

- Note the sensitivity results in Table 1 Section 4 if not, perhaps in appendices to Public Report.

- Note the material price ranges on the company risk register.

- Regularly review the long-term price forecasts along with all modifying factors.

- Communicate that fluctuations of 5-6% are normal and minimize inclusion of material that cannot stand the test of time.

- Assess early and warn the CEO well ahead of time if a downgrade is coming and have a write down review process.

The CEO and the market are likely to want the following questions answered (in a couple of pages with graphs and tables):

- What assumptions were used? (Note the sign-off obtained at the start of the process).

- For a range of prices where is the operation NPV positive?

- At what price are the operation’s cash margins zero?

- What are the impacts on the Ore Reserve estimate tonnages for the price ranges?

- Is there any upside from an increase in price?

- At what price (higher and lower) should we consider going back and changing the mine design?

- What are the opportunities to refine the cut-off grades or specifications?

Sensitivity methods

Assessments of sensitivity to price changes can be undertaken at the study stage, during Ore Reserve Estimation, and also in the company financial models. All are important, and the methods vary for underground and open pit operations.

- Study stage: At the study stage, the sensitivity is strategic in nature. A range of factors can illustrate the economic options for size and mining method of operation; production rate and cut-off grade, and identify material drivers.

- Ore Reserve Estimation: A mining method exists and price sensitivity may trigger modifications, reductions or increases in areas of the operations, production rates and/or cut-off grades. This can be used to illustrate and communicate materiality.

- Company-wide financial models. The mining method, production rates, cut-off grades are usually fixed so it’s just the non-resource modifying factors that can be evaluated. The benefit of this is usually a complete model with all factors and stakeholders involved. During Ore Reserves Estimation it is essential the Competent Person who sees this model, inspects factors used and understands the sensitivity done. It is this sensitivity result that should be noted in Public Reports.

Open pit and underground sensitivity:

Open pit

When designing an open pit, a common process, called pit optimization, is run to select a pit shell from a generated set of nested shells. One of the shells will have the desired profit point for the organization. Part of pit optimization process is to assess sensitivities against a number of modifying factors, such as price, cost and slope angles. Once the preferred pit shell has been selected, final design is created from this shell, and a mining schedule established.

Good practice in open pit sensitivity includes:

Involving key stakeholders in pit shell selection and sensitivity results, including ? those conducting financial modelling?.

For material changes in price, a full revision of the pit-optimization, design and schedule will be required.

Non-material changes in price can be managed through the financial model, and sensitivity will be observed in increases or decreases in the operation’s NPV.

The Competent Person could identify scheduled mining areas which could be placed on hold for lower prices or brought in for higher prices. The areas may be complete pits, staged pushbacks or a change of pit depth.

Underground

In underground mining the cut-off grade is the primary decision influencing the mine design A number of different sized ore-bodies can be designed at various cut-off grades. There are often a number of cut-off grades in a mine, according to purpose, for example for development and for stoping activities.

Good practice in underground sensitivity includes:

- Defining the various cut-off grades. Picking the breakeven cut-off grade gives a breakeven result, so good practice is to ensure the operation’s net present value (NPV) target is included.

- Creating [CA1] a sensitivity matrix of prices and costs. Software exits that can quickly create stope shape scenarios that can be assessed for feasibility. Compiled in a matrix with cut-off, production rates and resulting NPV, some sensitivity to price can be illustrated.

- Estimating correct operating and capital costs. This can be a large challenge especially for overseas underground operations.

- The Competent Person could identifying production stope areas, which could be placed on hold for lower prices or brought in for higher prices. This may mean mining is limited to areas that already have access and are close to extraction points. Deeper development may be put on hold. It is important to understand the impacts of selective mining in these cases to minimize loss of future Ore Reserve (sterilization).

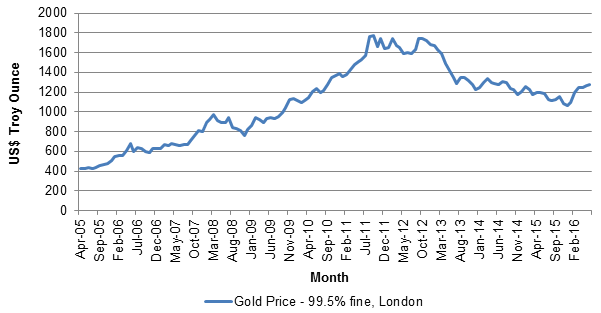

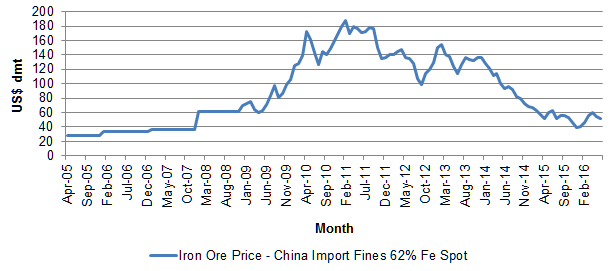

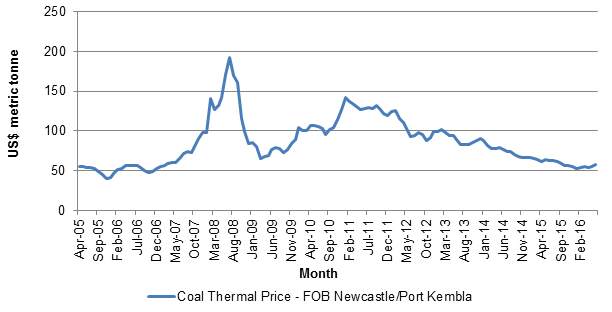

Examples of fluctuations in commodity price

Commodity prices fluctuate, gold, thermal coal and iron ore Figures 1 to 3 illustrate these fluctuations for gold, thermal coal, and iron ore. The source of data for this was

http://www.indexmundi.com/commodities. It is important to understand what the past fluctuations have been, the spot price and long-term real price forecasts. A sensitivity analysis should be done on a range that is large enough to reflect the annualized volatility rate across a number of market cycles. E.g. there is limited use in presenting a sensitivity range of ±10% when the real metal price can move ±30% in one year.

Further Reading:

AusIMM Monograph 30, Mineral Resource and Ore Reserve Estimation, The AusIMM Guide to Good Practice 2014 Mineral has some relevant articles on this topic, they are:

- The Influence of Revenue and Cost Factors on Ore Reserve Estimation – RP Watkins (Chapter 5).

- Reserves, Reserves and not a Tonne to Mine – A Study of Reserves Reported Prior to Mine Closure M Creech (Chapter 7).

Summary answers to price questions.

Q1. As a Competent Person, how can I be confident of the price I am using?

A1. The price is often supplied by finance. Ensure you have asked for an appropriate price and the units (usually a long-term real forecast price). Sometimes the price can be sourced from an independent forecasting organization. Examine the prices, check against historical trends, ranges and the consensus forecasts. Ensure key stakeholders agree on the price being used to avoid late revision and re-work.

Q2. When does a change in real long term price trigger a new Ore Reserve?

A2. The Competent Person should be aware of the sensitivity of all modifying factors used in estimation of an Ore Reserves. This can be done in study stage, pit or stope optimization work and through company financial model sensitivity. Good practice would be to note where the long-term price may trigger a revision of the mine design on a company risk register and to regularly review factors. Sensitivity and communication of the sensitivity it essential to be able to answer questions and inform investors in Public Reports, especially if the spot price is lower than the real long term forecast.

Q3. How does the Competent Person defend the Ore Reserve when prices change?

A3. Table 1, Section 4. In Revenue and Market assessment the Competent Person can mention source of forecasts, sensitivity work done and the range of real long term prices the Ore Reserve estimate is valid for. It is important to refer to the long term real price forecasts and not react to daily changes.

Q4. What are some good practices to test sensitivity to price?

A4. At the mine design stage, options for size, production and cut-off can be sensitivity tested for various factors, including price. This can communicate sensitivities for price and when changes to the mine design may be required. Ore Reserves Estimation methods will involve sensitivity on open pit shell choice and underground stope size optimization. During the Ore Reserves process it is essential the Competent Person reviews the company financial model to examine values used and sensitivity performed on that model.

Q5. What happens to an operating mine when the price decreases materially from the long term forecast?

A5. This is a business decision. Depending on the company’s position they may continue to operate, place on care and maintenance or close the operation. As a Competent Person it is important that you have communicated the sensitivity of the Ore Reserve estimate to price and that you have provided options to communicate areas that may assist the operation. Annual consent provides an opportunity for a revision, but communication, using the sensitivity can help the Competent Person and CEO in their decisions and to keep the market informed.

An modified version of this article first appeared in the December 2015 edition of The AusIMM Bulletin. For more information of to discuss this article further, please contact your closest AMC office.

Kate Sommerville

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights